Banking that's easier and convenient for you.

With Stockgrowers State Bank Mobile Deposit you can make a deposit directly into your eligible checking or savings accounts anywhere, anytime, using the SSB Mobile App.

- Sign in to the Mobile App

- Click the menu icon and then select Mobile Deposits

- Click the icon to create a new mobile deposit (+ for Android & ... for iOS)

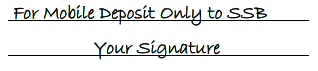

- Endorse the back of your check with "For Mobile Deposit Only to SSB" and Your Signature

- Choose which account you wish to deposit the check into

- Enter in the amount of the check

- Snap a photo of the front and back of the check

- Submit your deposit

Mobile Deposit FAQs

You must be an active SSB customer, signed up for Online Banking services and have the SSB App downloaded on your mobile device.

Mobile Deposit is supported through our Mobile App, available on Apple devices (OS of 9.0 or later) and Android devices (OS 4.1 or later).

Sign on to your SSB Mobile App then follow these steps:

- Click the menu button and select Mobile Deposits.

- First-time customers will be taken through a short enrollment process, including the SSB Mobile Deposit Service Agreement.

- Select the + (plus) Icon to create a new deposit. Take a picture of the front and back of your endorsed check with your mobile device. For photos that work best, follow these guidelines:

- Place your check on a dark-colored, plain surface that's well lit

- Position your camera directly over the check (not at an angle)

- Fit all 4 corners in the guides of your mobile device's camera screen

- Select the account you wish to deposit to.

- Enter the amount of the check

- Submit your deposit

You will receive a confirmation message on your mobile device for each successful submission.

On some mobile devices, you may need to change the permission settings of your device's camera. This enables the SSB Mobile App access to use your device's camera for mobile deposit. Permission settings can be found under the device's settings.

$2,500 per deposit

$5,000 daily

You can make multiple deposits in a single mobile session. Each check is a separate deposit. There is no limit to the number of checks you can deposit in a day.

You can deposit checks payable in U.S. dollars and drawn at any U.S. bank, including personal, business, and government checks. They must also be payable to, and endorsed by, the account holder.

Items not eligible for Mobile Deposit include international checks, U.S. savings bonds, U.S. postal money orders, remotely created checks (whether in paper form or electronically created), traveler's checks, convenience checks (checks drawn against a line of credit), and cash.

6:00p PM CST

Items transmitted by the Depositor and received by SSB or its subcontractors by 6:00 PM. Central Standard Time ("CST") Monday through Friday, shall be credited to the Depositor's applicable account on the same Banking Day. Items received by SSB after 6:00 PM CST on any Banking Day shall be credited to the Depositor's applicable account on the next successive Banking Day. Images of items transmitted by Depositor are not considered received by SSB until Depositor has received an electronic confirmation of the receipt of the deposit from SSB. However, receipt of the confirmation from SSB does not mean that the transmission was error free or complete.

We will make funds available for checks and items received, accepted, and successfully processed through the Service according to our standard funds availability policy for your Mobile Deposit Account.

Yes, mobile deposited checks still require proper endorsement on the back of your check. Write on the endorsement line: "For Mobile Deposit Only to SSB" and include your signature

If a problem arises with your deposit, such as a returned check, we will contact you at the phone number or email address we have on file for you. We may also contact you via SSB Online Banking or SSB Business Online Banking or other communication channels at our discretion.

Securely store your check for 30 days after your deposit, and then you destroy it. This allows sufficient time in case the original check is required for any reason.

The Mobile Deposit service is provided at no charge to you. However, please check with your wireless provider about carrier and web access charges as your mobile carrier's message and data rates may apply.

We use advanced encryption and security technology:

- Online banking credentials are not stored on your mobile device.

- Check images are not stored on your mobile device.

- You view accounts by nicknames you can define, not by account numbers.

- 128-bit encryption masks your sensitive information.

Remember for added security, always sign off completely when you finish using the Stockgrowers State Bank app by selecting Log Out.